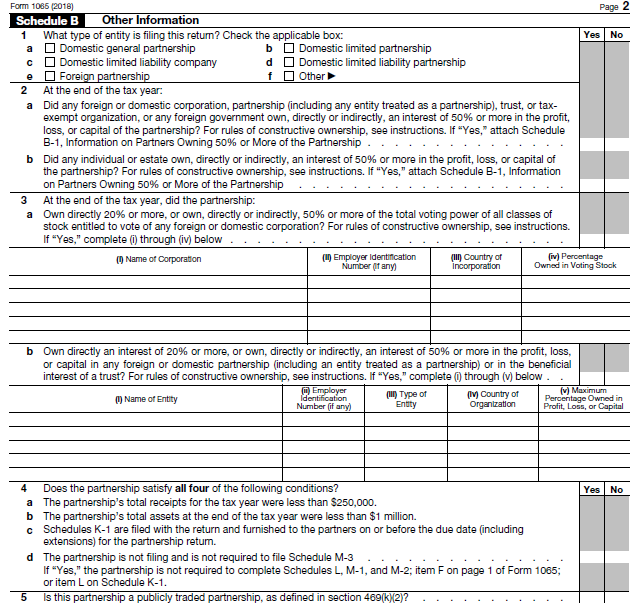

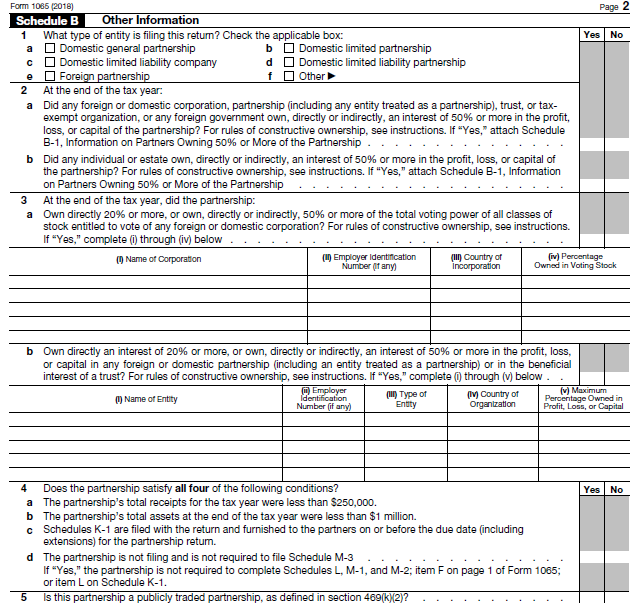

To answer this question in the partnership return in TaxSlayer Pro select: Whether or not the partnership satisfies these four requirements is a Yes/No question on Schedule B (Form 1065) line 4 (line 6 prior to 2018).

The partnership is not filing nor is required to file Schedule M-3. Schedule K-1s were filed with the return and furnished to the partners on or before the due date (including extensions). The partnership’s total assets at the end of the tax year were less than $1 million. The partnership’s total receipts for the tax year were less than $250,000. When is Schedule M-1 not required?Ī partnership does not need to complete a Schedules L (Balance Sheet), M-1 (Reconciliation of Income), and M-2 (Analysis of Partner’s Capital Accounts) if it satisfies all of the following four requirements: Not all partnerships are required to complete Schedule M-1. Return of Partnership Income, Schedule M-1 is used to reconcile the income that the partnership is reporting on the tax return with the income in its accounting records. Deductions on the tax return but not deducted on the books this year. Income recorded on the books this year but not included on this tax return, and. Expenses recorded on the books this year but not deducted on this tax return. Income subject to tax but not recorded on the books this year. There are four general categories of differences: Some of the differences are due to timing, i.e., when an item of income or expense is recognized, whereas other differences are permanent. This difference arises due to differences between tax law and generally accepted accounting principals. In many cases there is a difference between the profit or loss on a partnership's accounting books versus what is reported on its tax return.

The course and instruction delivery are geared toward a basic understanding and progress to more complex issues via Surgent’s “Step-by-Step” preparation guide.What is the purpose of Schedule M-1 in the partnership return?

We bring it all together in the final two chapters with a comprehensive example that integrates and links all previous chapters. Within each chapter, we illustrate various parts and areas of interest when preparing a 1065, including examples and corresponding tax forms. Common to advanced issues of partnerships are explored in the current course that can double as a quick and practical reference guide for tax treatment and tax preparation guidelines. The objective of this course is to train new, rusty, or returning-to-practice staff with a hands-on, pencil-pushing gold standard for preparing Form 1065.

0 kommentar(er)

0 kommentar(er)